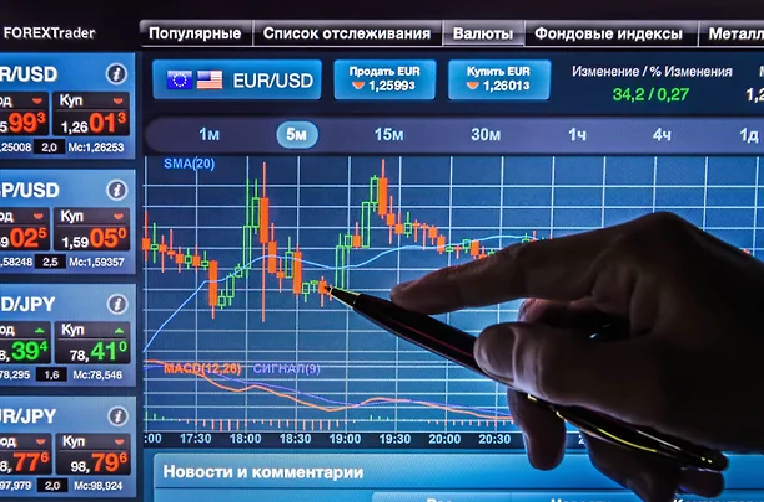

Special platforms are created for trading on stock markets, allowing for currency operations.

Forex fraud is intentionally directed actions aimed at obtaining finances from potential victims through deception by misleading them using psychological manipulations and emotional pressure. Fraudsters on this platform include pseudo-brokers, sellers of fake software, and deceptive training courses with guaranteed high income.

Fraud on Forex

The most common fraud schemes on Forex are:

- selling user software and tools for trading platforms;

- high-yield Forex guarantees, where brokers with sites similar to payment gateways are removed after collecting money from victims;

- creating financial pyramids, constantly attracting new investors, with payouts made from the previous users' funds;

- manipulating quotes and prices, working with trades that worsen profit conditions for clients but increase fraudsters' profits;

- social engineering with psychological pressure and playing on human emotions, convincing the victim to constantly invest money without withdrawing profit.

Scam Brokers

Well-known fraudulent schemes on Forex:

- allowing multiple reviews, exploring personal ratings, where brokers at the top can share commissions with high-rating sites;

- promoting affiliate links and earning ratings;

- users are misled and fall for such a scheme.

Also common is a scam where fraudsters pose as employees of companies that assist victims of broker scams and help them get their money back. They require payment for their services, adding associated costs, thus draining the victim of their last funds and eventually saying they've done all they could, the issue is unsolvable, and then disappear from the victim's sight.

Fraudsters in the Forex Market

It's important to understand that most fraudsters in the forex market play on human emotions and greed, dreaming of making easy money quickly. Therefore, all schemes and psychological influence methods are employed. The most common information that victims fall for is the promise of high returns using bright fake advertising on social networks and messengers.

Forex Scam

A common scam on Forex is fake courses on trading training and charging for a fake course that supposedly teaches trading on the currency market. In this case, only the first introductory course is offered, which is useless and won't help in learning. They also sell useless books, brochures, video lessons, earning in any way possible.

Illegal Forex Brokers

These are fraudsters as they lack licenses, although even licensed brokers can be scammers. The absence of the appropriate license allows the broker to use a fake website on the internet, enabling them to shut down the site at any moment or, having deceived investors, restrict withdrawal of funds.

Fake brokers do not bother with registration, so you won't find on their sites:

- physical office address;

- personal data of the creators;

- segregation of accounts, where the broker's account and the client's account are kept separately.

How Not to Lose Money on Forex

To protect your finances from fraudsters while working on Forex, you should know some rules of conduct on financial platforms:

- do not share information about bank cards, passwords to them, and financial accounts;

- use two-factor authentication;

- install antivirus software;

- use a VPN to hide the possibility of location tracking;

- use different passwords for different software;

- alternate encryption methods, don't forget password managers to avoid writing each one down separately;

- do not install any programs and do not visit sites through unfamiliar links received by email or message.

Forex Financial Pyramids

Fraudsters on Forex use pyramids, the essence of which is that by investing money in companies or platforms, investors receive profits by attracting new clients.

Such pyramids exist:

- On a marketing platform, here they attract investors using unique tools, luring them with various trading models or proprietary advice. In this scheme, only the initial investors may profit, or no one may profit;

- B book brokers - these are platforms on websites where trades are not executed externally but within the system, using counterparties' properties. Here, the fraudster is not interested in clients' profits, and payouts can also be made from new investments of users;

- Fake companies managing funds, using messengers, are insider trading groups to attract investors by convincing them with information that would allow them to earn decently if investments are made immediately.