The stock market has become an integral part of the modern economy and an important tool for building personal wealth. However, as in any other area, financial fraud, scams, and various schemes can be found here. Knowing about such risks and how to protect your investments is what can help investors avoid losses and preserve their funds. In this review, we will take a detailed look at various types of fraud in the stock market, the methods used by scammers, and strategies that allow investors to protect themselves.

Types of Financial Fraud in the Stock Market

There are many ways in which fraudsters can deceive investors. These include:

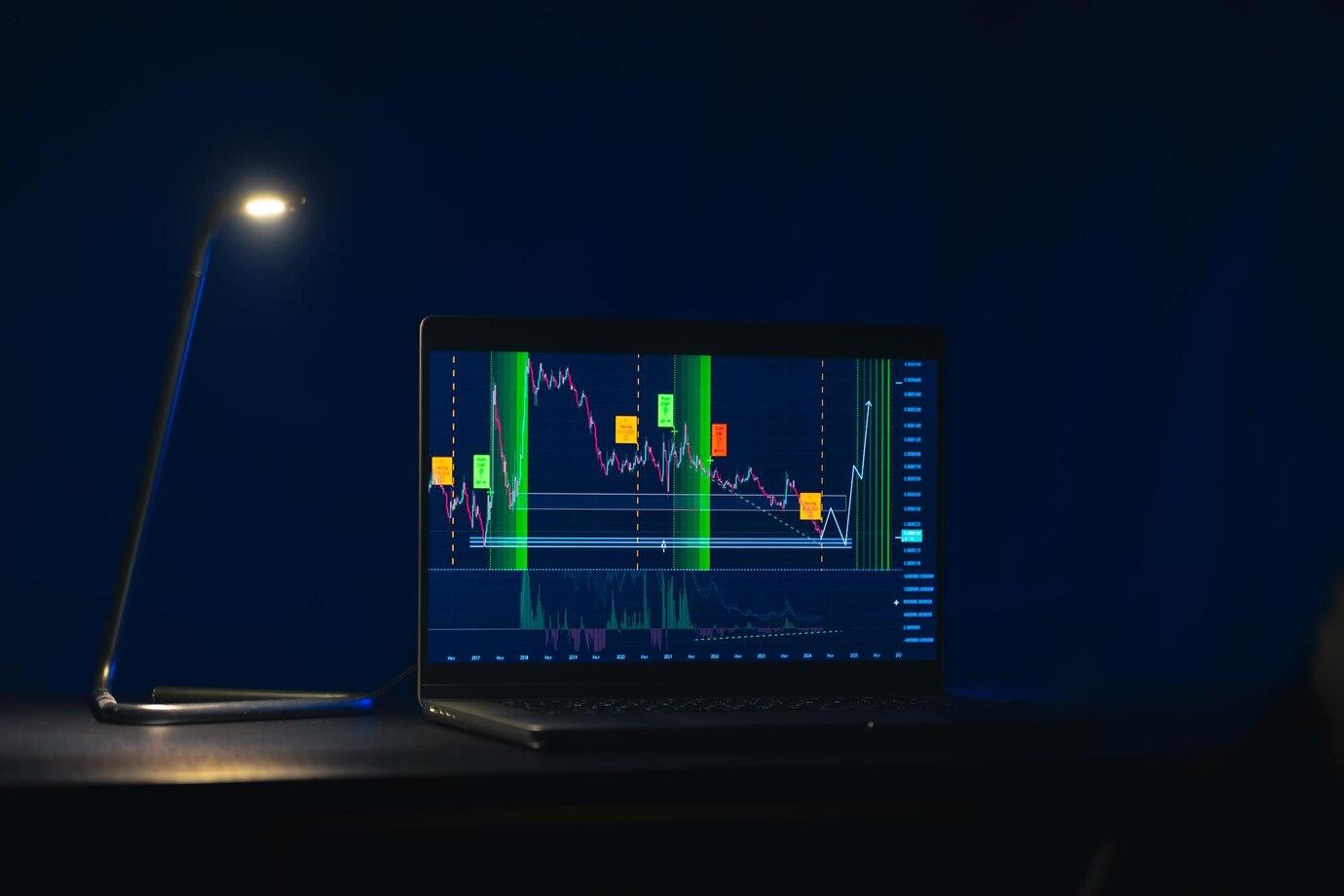

- Pump and Dump. “Pump and Dump” is one of the most common fraud schemes that uses stock price manipulation. In this scheme, a group of people starts actively promoting certain stocks, creating artificial excitement. They may use false news, social media, and forums to spread information to attract the attention of investors. When the stock price rises to a certain level, the scammers begin to sell off their assets, causing the price to collapse. Investors who bought stocks at inflated prices are left with losses, while the fraudsters make a profit.

- Fraudulent Investment Funds. Some fraudsters create fictitious investment funds, promising high returns with low risks. Such funds usually sound very attractive — for example, "Guaranteed income of 20% per year." In practice, investors find that their money disappears and the fund itself turns out to be non-existent.

- Fake Strategies and Signals. In recent years, a large number of platforms and services offering trading signals have emerged. It is important to understand that many of them are scams. They promise high profits in a short time, but in reality, they manage assets only for their personal interests, not those of the investors.

- Credit Fraud. Investors may also encounter credit fraud when scammers offer them loans to buy stocks using fake documents and guarantees. As a result, investors end up owing money, and the stocks purchased on credit may turn out to be worthless.

How to Protect Yourself from Fraud

Protection against financial fraud requires attentiveness and awareness. Below are key measures that can help investors avoid pitfalls.

Check Information

Before investing, be sure to check all available information about the stocks, fund, or platform. Study reviews from other investors, information about managers, and their history. Reliable sources of information may include financial stars, peer-reviewed scientific publications, and company reports.

Be Wary of Promises of High Returns

If someone offers you investments with guaranteed high returns and minimal risks, this should raise a red flag for you. The real investment market is associated with risks, and no serious analyst will promise minimal risks with high returns.

Use Licensed Intermediaries

Invest through licensed and reputable brokerage companies. If an unknown broker offers you services, carefully check their reputation. Ensure that they are registered with the appropriate financial regulators. Different countries have their own regulatory bodies that oversee the activities of financial institutions.

Education and Skill Improvement

Continuous learning and participation in investment seminars can help you stay informed about new fraud schemes and business practices. Familiarize yourself with the basics of the stock market and major financial instruments.

Exercise Caution with Private Offers

If someone tries to deceive you into investing in private offers or schemes that are not publicly accessible, be very cautious. Most often, such schemes are used to deceive trusting investors.

The Role of Regulatory Bodies and Legislation

One of the important aspects of combating fraud in the financial market is the work of regulatory bodies. In different countries, these may be securities and stock market commissions, as well as financial regulators. These bodies monitor compliance with rules and the protection of investors' rights.

Leading organizations, such as the Securities and Exchange Commission (SEC) in the USA or the Bank of Russia, actively work on identifying and suppressing fraudulent schemes. They conduct investigations and can impose sanctions on unscrupulous companies and brokers, as well as inform investors about the emergence of new schemes.

Conclusion

Financial fraud in the stock market is a serious threat to investors. Knowing the types of fraud and taking precautions can significantly reduce risks. It is important to be attentive, check information, and use only reliable sources for investing. We hope this article has helped you understand the dangers of the stock market and how you can protect your investments from scammers. Investing can be profitable, but only when it is based on awareness and caution.