Not so long ago, bank cards were used exclusively for withdrawing cash from ATMs. Progress, as we know, does not stand still, and financial awareness and knowledge of the population are developing daily. Today, these plastic helpers are widely used for paying for services and goods in various fields, from grocery stores to spa salons, administrative service centers, and online supermarkets.

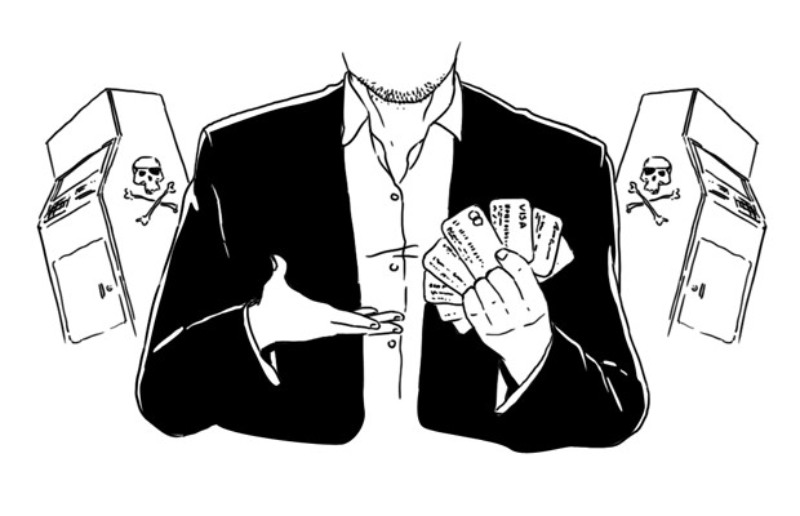

Card Fraudsters Rob the Population

With the development of contactless payments, fraudsters have found many ways to abuse this system. Using portable terminals, data can be read in public places. Card fraud is one of the most common and rapidly developing forms of financial deception. The development of technology has also contributed to the increase in the number of methods used by criminals to steal money using both physical and digital methods. Learning how money is stolen from cards is not difficult. Understanding the main types of fraud and knowing how to protect yourself from them will help keep your finances safe.

Main Types of Card Fraud

- Card Skimming. Skimming is a type of scam where criminals use a special device – a skimmer, to copy information from the card's magnetic stripe when it is inserted into an ATM or terminal. Hidden cameras are often installed to record the entry of the PIN code.

Before using an ATM, it is better to check for any suspicious overlay devices. Also, it is not superfluous to cover the keyboard with your hand when entering the PIN code.

- Phishing is when data is extracted through fake emails. Such notifications may appear to be sent on behalf of the bank or a well-known online store at first glance, but they contain fraudulent links leading to websites where the next step is to request card data. It is important to remain vigilant and not click on suspicious links sent from unknown email addresses.

- Carding – in this case, criminals steal personal information for online purchases. Data theft from a card can occur due to hacking of online stores or through unsecured networks.

It is worth making secure card payments and making purchases only on verified and secure sites. Another thoughtful and safe move is a virtual account for online shopping with a limited validity period, which reduces risks.

- Contactless Theft. Criminals may use portable scanners to discreetly capture information from a contactless card in a public place.

Special card cases that block RFID signals can serve as protection.

- Vishing – a type of phishing where fraudsters use phone calls to extract data. During the conversation, the scammers pose as bank employees, trying in every way to persuade you to provide the required card number, PIN code, and other confidential information. They may threaten account blocking, blackmail with client status liquidation, to evoke panic and fear, - in such a state, a person involuntarily becomes ready to disclose any data to return to a state of emotional comfort as soon as possible.

- Using the "social engineering" method involves psychological techniques to manipulate people into revealing banking information. Techniques vary: calls, messages in messengers, and even personal meetings are not excluded. Fraudsters assume various roles, inventing cunning scams and posing as company executives, police officers, or even friends.

Double Charging – sometimes, scammers may attempt to charge a card twice for the same transaction. This can occur when shopping in stores or making online orders. In some cases, if a transaction was declined, scammers may repeat it to withdraw funds again.

Protection Against Bank Card Fraud

All the most popular fraudulent tricks share one common characteristic – psychological methods are present in any method. Communication with potential victims is conducted using NLP techniques and various other methods of psychological influence and manipulation of human consciousness. The scams and fraudulent schemes are thought out as precisely as possible to avoid any slip-ups. Even focused people with maximum concentration can lose vigilance in some situations under the influence of "scam specialists".

It is worth knowing and constantly remembering a few rules about not disclosing information about bank accounts, personal CVV codes for card access under any circumstances.

Top 5 Effective Protection Methods

How to protect yourself from card fraud? There are several effective methods that will help protect your funds from disappearing.

- Setting limits on transactions. Some banks allow setting daily transaction limits, which reduces the risk of large losses in case of fraud.

- 3D Secure Technology – additional protection for online payments, requiring confirmation through a one-time password or code.

- Activating SMS notifications – to be aware of any transactions and immediately identify suspicious activity.

- Updating passwords and using unique codes. Regularly changing online banking information and complex combinations make it difficult for fraudsters to gain access.

- Attention to suspicious messages and calls. Do not disclose personal information without verifying the source and purpose of the request.

Card fraud is a real threat in today's world, but knowing the main schemes and safety measures can help reduce the risk of becoming a victim of criminals. Protecting yourself from unwanted risks can be achieved by increasing financial literacy to have up-to-date information and be able to resist fraudsters. Armed with knowledge about the main types of card fraud and protection methods, one can make informed decisions and avoid falling into the fraudsters' traps.